From My Facebook Page Michael Laitman 4/17/19

What do I wish the people of Israel this Passover?

Connection. That’s all we need.

Connection. That’s all we need.

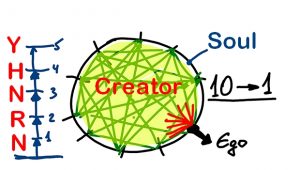

When human beings discover the true essence of Creator and behaves according to the nature of the grantor or giver, that approach is so intense that he realizes that does not need the religion, it remains only as part of their cultural and social environment in this world.

The descent of the worlds from top to bottom is built in such a way that due to its actions, the creation increasingly reveals its Master’s attitude toward it. It seems to be in the process of research. In the spiritual world, it is impossible to search for answers with our rational logic—we must penetrate it sensorially and then we will understand more. Then, from our sensations, we can find an explanation in our reason.

The descent of the worlds from top to bottom is built in such a way that due to its actions, the creation increasingly reveals its Master’s attitude toward it. It seems to be in the process of research. In the spiritual world, it is impossible to search for answers with our rational logic—we must penetrate it sensorially and then we will understand more. Then, from our sensations, we can find an explanation in our reason. Question: What is the “revelation of the Creator to the created beings in this world”? Is it possible to compare the revelation of the Creator with the revelation of the laws of magnetism or electricity? Do we simply learn how to use those laws of nature that were previously hidden from us?

Question: What is the “revelation of the Creator to the created beings in this world”? Is it possible to compare the revelation of the Creator with the revelation of the laws of magnetism or electricity? Do we simply learn how to use those laws of nature that were previously hidden from us?

The egoistic desire works perfectly in this world when it clearly sees a reward in front of it, can weigh the benefits of its actions, and then decide where and how much to exert. Egoism can fight for a reward.

The egoistic desire works perfectly in this world when it clearly sees a reward in front of it, can weigh the benefits of its actions, and then decide where and how much to exert. Egoism can fight for a reward. Question: Everywhere and always I separate my “I.” The feeling of isolation from other people disallows me from connecting with them. I push them away. What should I do?

Question: Everywhere and always I separate my “I.” The feeling of isolation from other people disallows me from connecting with them. I push them away. What should I do? I watch the news about what is happening in the country and in the world, and I rejoice at the wicked being revealed, that is, the revelation of the evil of the egoistic desire that demands to be corrected. The ego is screaming, begging us: “Why are you not correcting me?! To what extent do I have to reveal myself and immerse myself in the world?”

I watch the news about what is happening in the country and in the world, and I rejoice at the wicked being revealed, that is, the revelation of the evil of the egoistic desire that demands to be corrected. The ego is screaming, begging us: “Why are you not correcting me?! To what extent do I have to reveal myself and immerse myself in the world?”

Question: When we talk about faith above reason in Kabbalah does it mean the same as the word “faith”does as is generally accepted in our world?

Question: When we talk about faith above reason in Kabbalah does it mean the same as the word “faith”does as is generally accepted in our world?